Location: Surrey Hills

Client Brief: Our clients had a fairly open brief. The client had up to $900k and wanted us to recommend a property type and location that was going to deliver the highest capital growth.

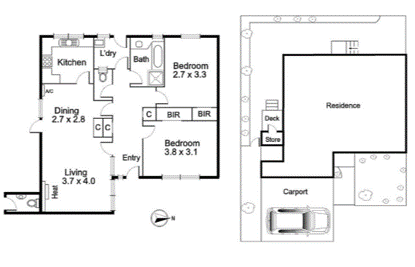

Our Solution: We purchased off market a 3 bedroom villa in Surrey Hills. We negotiated directly with the owner – no agent. Purchased January 2021 for $835K, rent $28,944 p.a, same tenant for 16 years

Starting gross yield of 3.5% and value 6 months later was over $1.1M. Our client bought his family home, holiday home, investment property and has engaged us again.

Location: Oakleigh

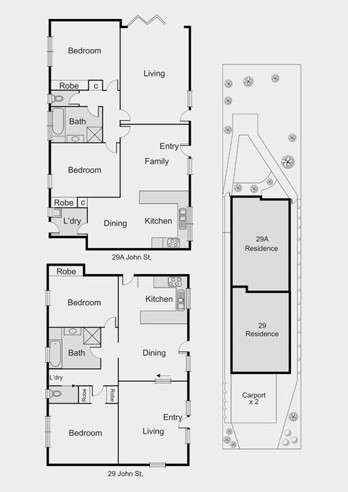

Client Brief: Client wanted a value add investment that could also potentially serve as a home in future. If we could buy a house that had good rental return on a large allotment of land in Oakleigh and surrounds this would be ideal.

Our Solution: We delivered a dual occ site. Purchased 2020 for $1.2M. Large land holding of 762 sqm with an original 3 bedroom house at the front and a 3 bedroom villa at the back. Current rental income of $39,516 per annum. Gross rental return of 3.3%.

A land sale in the street sold in 2020 for $1,677 a sqm which placed this properties land value at $1.28M (762 sqm) without considering the two rental properties.

Location: Balwyn

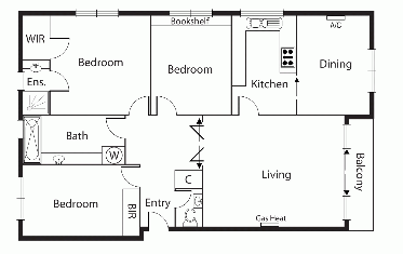

Client Brief: Our client wanted to invest in something with good capital growth prospects in blue chip area.

Our Solution: We secured this property which had some fantastic value add with a sizeable footprint of land at the front and rear of the block. Bought December 2018 for $676k.

Property next door on less land sold for $860k in March 2018.

Location: Reservoir

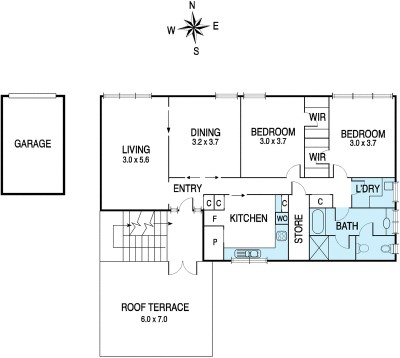

Client Brief: Investment property that was immediately rentable with future development potential for less than $820K.

Our Solution: This property was immediately rentable and was on 800 sqm of land. Next door had already received approval for 4 units so this was great buying in 2016 for $800,000.

Bought via private negotiation.

Location: Elwood

Client Brief: Our client had $1.5M to spend but wanted something a bit different and a good rental return.

Our Solution: A unique proposition in Elwood, offering tow properties on 515 sqm of land.

Purchased at auction May 2013 for $1.275M. The starting rental was $50,000 p.a or nearly 4% gross yield. The capital growth prospects are also very strong on this one.

Location: Toorak

Client Brief: Client wanted a property with good value add that would also deliver a strong rental return for their SMSF.

Our Solution: Purchased for $685,000 in 2012. This 3 bedroom apartment, with additional dining space, 2 bathrooms, north facing balcony with 2 car spaces and storage in a boutique block – 1 of 10 (no lifts or expensive maintenance issues).

Starting rental yield of 4.2% with capacity to update and be cash flow positive from Day 1 and located only 100 metres away from the prestigious Toorak village shops, cafes and transport where new units in the street selling for over $3M.

Location: Kew East

Client Brief: Our cleint was seearching for a property in a premium pocket for less than $800k with a good rental yield

Our Solution: We purchased 3 bedroom + study in 2011 for $740,000.

Rent was $700 per week. Starting gross yield of nearly 5% in a premium location with excellent capital growth prospects.

Bought 6 days after the auction. The property was originally marketed at a high price point which had a negative impact on the campaign. This allowed us to swoop post auction and secure this great investment.

Location: Kew

Client Brief: Our client wanted something unique with good scarcity value

Our Solution: We secured a 2 bedroom apartment + separate dining that could e converted to a 3 bedroom for $571,000 in 2021 with a starting rent of $450 per week bought via private negotiations.

As far as scarcity value is concerned this has it in spades. Good size accommodation in a small boutique block, with a huge outdoor terrace with views to the city in a great location of Kew.

Ticked all the boxes.

Location: Prahran

Client Brief: Our client wanted something a property where they could add value.

Our Solution: A multiple investor that has purchased 4 times through Buyers Advocate that allowed them to develop sizeable equity in a short period of time.

We purchased a dual occ prime for renovation for $950k. Bank valuation came in shortly after for $1.275M after some cosmetic updates.

Large profit after only 2 months work with a rental of $1,100 per week!

Location: Glen Iris

Client Brief: Our client was referred to us by an Accountant with the objective of purchasing their first investment property for their Self-Managed Super Fund. The brief provided was to acquire a property under $800,000 that would deliver maximum capital growth over the next 10- 20 years.

Our Solution: Given the state of the market at the time the best value solution seemed to be in the blue chip Eastern Suburbs for a recently renovated 2 bedroom villa with a generous floor plan in leafy Glen Iris with 2 double garage, huge courtyard and on 167 sqm of land.

Purchased $757k in May 2019

Valuation at settlement $850k

Location: Kew East

Client Brief: An investor who was seeking an apartment in the Eastern suburbs of Melbourne, that would deliver good capital growth with a limited budget.

Our Solution: We recommended an older style apartment in East Kew, in a boutique block which offered some scarcity value.

Purchased this 2 bedroom unique in a boutique block in 2015 for $530k. This was the 2nd purchase for this client.

Location: Camberwell

Client Brief: A 1st time investor that that was seeking advice and expertise to make a decision about what and where to purchase an investment property to maximise return on investment and minimise any risk.

Our Solution: We recommended a 2 bedroom villa in the Eastern suburbs that had some land content. We focussed our research on property located at either the front or back of unit block with the objective of securing more land.

This was purchased in 2012 for $593k. Since updating this would now be worth well in excess of $1M.

Location: Camberwell

Client Brief: A renovator wanting a property they could flip and for quick profit. The client had purchased an apartment in 2009 which had returned a profit of $50,000 after costs.

However, on this occasion the client was looking to secure a larger profit, but with minimum risk.

Our Solution: We purchased this 2 bedroom 1 bathroom 2 car garage for $960k in March 2018 which our client converted to a 3 bedroom and fully renovated for approx. $110k.

Bought March 2018 $960k

Stamp duty $52k

Renovations $150k

Sold November 2018 $1.348M

Selling costs $20k

Profit Approx $200k in 6 months

Location: Brunswick

Client Brief: Before engaging our services the developer had bought a couple of properties that had not performed well and they approached us to accelerate their investment portfolio.

We purchased them two properties that performed exceptionally well. Within 5 years we then moved to a larger development opportunity which this assessment now focusses on.

Our Solution: Purchased 346 sqm of land in Prime Brunswick

Bought for $680k in May 2011

Joined forces with neighbouring property and have a permit to build a six storey building with 34 dwellings. An unbelievable result!

Location: Highett

Client Brief: The investor had previously engaged our services to purchase a property which had performed well. They were now exploring property development opportunities. They were interested in a land purchase in an up and coming area which provided development potential.

Our Solution: We explored opportunities to secure land that had development potential in a location that was gaining popularity. We explored options that where within 20-30 km’s of Melbourne’s CBD.

Secured a 1250 sqm site close to Highett Train Station

Bought $1.25M in April 2015 which the land had some contamination

Decontaminated the site for approximately $150k

Obtained permit for 26 apartments

Sold Dec 2017 pre-development for $2.8M